Trends Analysis of the Israeli market for new vehicles - Q1 2024

May 12, 2024

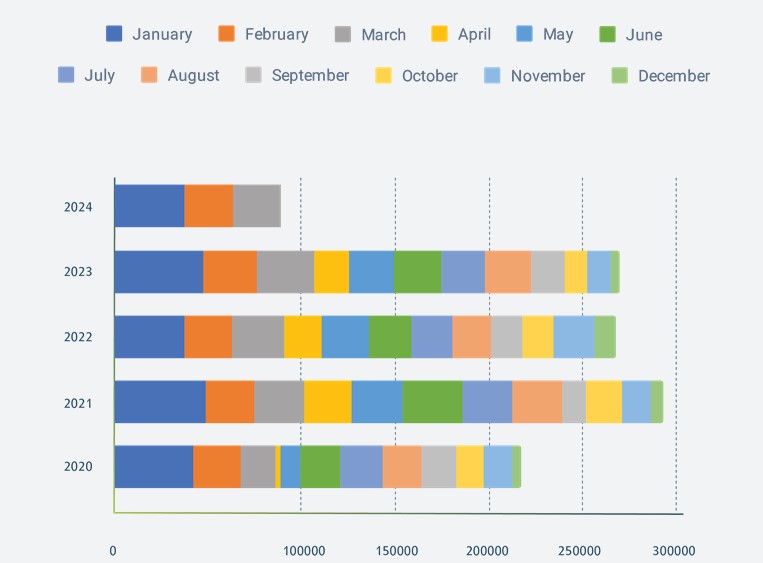

Registration Data

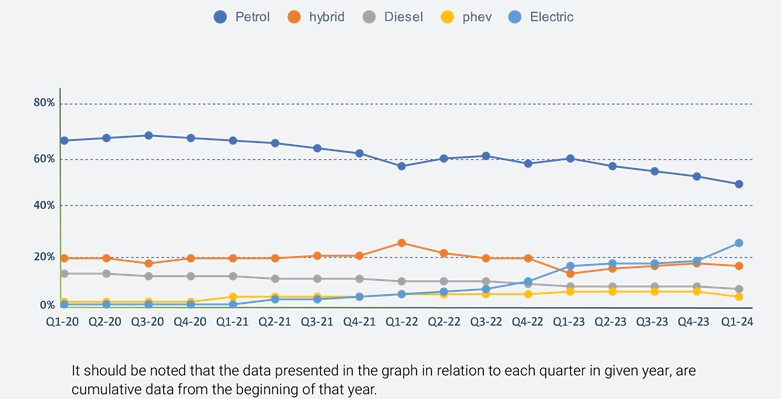

Registration by Engine Type

In Q1 2024, Israel’s automotive market continued to pivot significantly towards electric and alternative fuel vehicles, with traditional petrol engines seeing a persistent decline. Petrol vehicles comprised 48% of new registrations, marking a continuous decrease from 51% in Q4 2023 and a more noticeable drop from 55% in Q1 2023, and a substantial fall from 59% in Q1 2022, underscoring a steady move away from petrol dominance.

Electric vehicles showcased a remarkable upward trend, securing 25% of the market share in Q1 2024. This represents a considerable rise from 18% in Q4 2023 and 16% in Q1 2023, more than doubling from just 10% in Q1 2022. This rapid growth highlights the accelerating adoption and consumer shift towards electric vehicles.

Hybrid vehicles held 16% of the market in Q1 2024, reflecting stability from Q4 2023 showing increase from 13% in Q1 2023, and a significant drop from the 25% in Q1 2022.

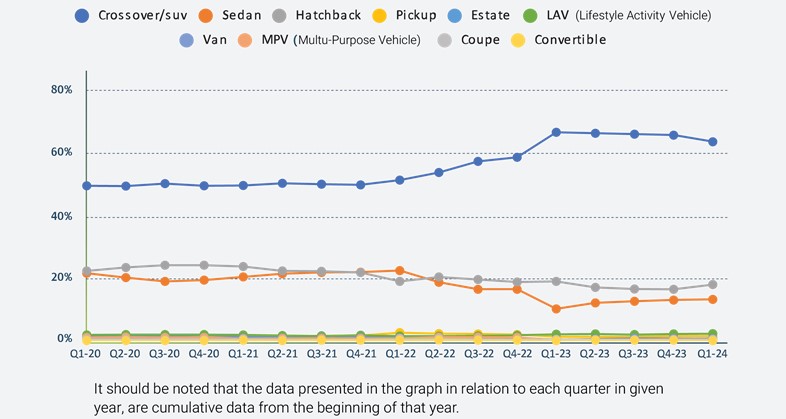

Registration by Segment Type

In Q1 2024, Crossover/SUV segment saw a decrease in its market dominance with a 62.9% share in Q1 2024, down from 65.0% in Q4 2023 and a decrease from 65.9% in Q1 2023, although it remains significantly higher than the 50.8% in Q1 2022. This illustrates a slight reduction from its peak but still shows strong consumer preference for larger SUVs.

Hatchbacks saw an increase in market share to 17.8% in Q1 2024, rising from 16.3% in Q4 2023. This is a recovery from a slight dip to 16.3% in Q1 2023, returning to the level observed in Q1 2022 at 18.8%. This indicates a rebound in popularity for hatchbacks after a temporary fluctuation.

Sedans also experienced a shift in market share to 13.1% in Q1 2024, slightly up from 12.9% in Q4 2023. This marks an improvement from 10.1% in Q1 2023 but still falls short of the 22.2% held in Q1 2022, suggesting a partial recovery amid ongoing competitive pressures from other segments.

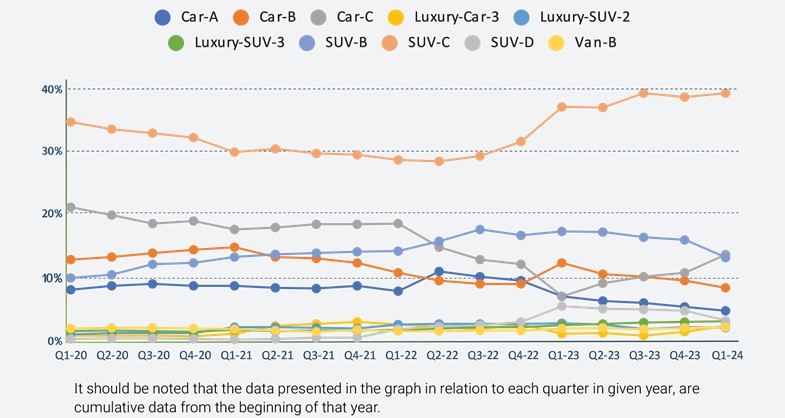

Registration by Category

SUV-C segment dominated the market with a robust 38.0% share of new vehicle registrations in Q1 2024, marking a slight increase from 37.4% in Q4 2023. This continued growth from 35.9% in Q1 2023 and a significant jump from 27.8% in Q1 2022 underscores the enduring appeal of larger, versatile vehicles in Israel.

SUV-B category - while still significant, observed a reduction to 12.1% in Q1 2024, down from 15.6% in Q4 2023 and a more notable decrease from 16.9% in Q1 2023, reflecting a downward trend from the previous year's higher interest levels.

The Car-C segment saw its market share increase to 13.4% in Q1 2024, rebounding from 10.6% in Q4 2023. However, this is still an improvement from the lower 7.0% in Q1 2023 but not quite reaching the much higher 18.1% in Q1 2022, indicating some recovery but overall variability in consumer interest over the past years. Lastly, Car-B segment's witnessed a reduction in its market share to 8.3% in Q1 2024, down from 9.4% in Q4 2023. This figure continues the downward trend from 12.1% in Q1 2023 and 10.6% in Q1 2022, indicating a shift away from smaller vehicle categories as consumer preferences evolve.

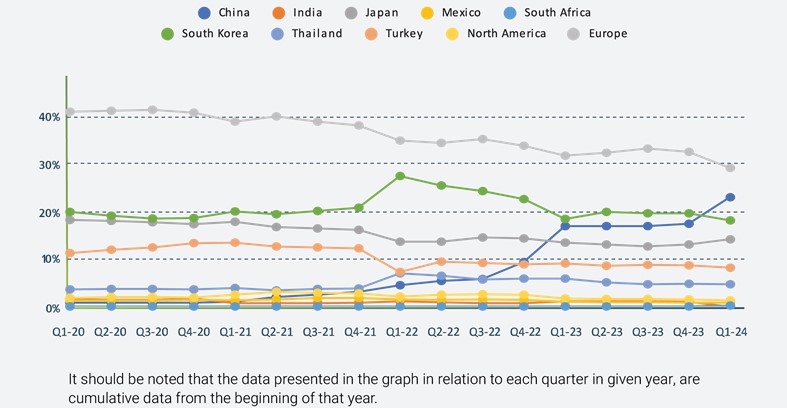

Registration by Country of Origin

European Vehicles retained their lead but exhibited a decline, representing 29.3% of the market, a decrease from 32.7% in Q4 2023. This trend marks a continued downward shift from 35.1% in Q1 2022, reflecting a gradual reduction in the dominance of European manufacturers within the Israeli market.

Chinese vehicles showed significant growth, securing 23.1% in Q1 2024, up markedly from 17.5% in Q4 2023 and 17% in Q1 2023, and a dramatic increase from just 4.5% in Q1 2022.

South Korean displayed a robust presence, accounting for 18.2% in Q1 2024. This figure is a slight decrease from 19.7% in Q4 2023 but shows an overall decline from the 27.6% observed in Q1 2022, reflecting some volatility but still holding a strong position in the market.

Japanese vehicles maintained stability, slightly increasing to 14.2% in Q1 2024, up from 13.7% in Q1 2022. The Turkish-made vehicles recorded 8.2% in Q1 2024, down from a peak of 9.1% in Q1 2023 but still higher than 7.1% in Q1 2022, suggesting a short-term peak followed by a slight retreat.