Trends Analysis of the Israeli market for new vehicles - Q3 2024

November 6, 2024

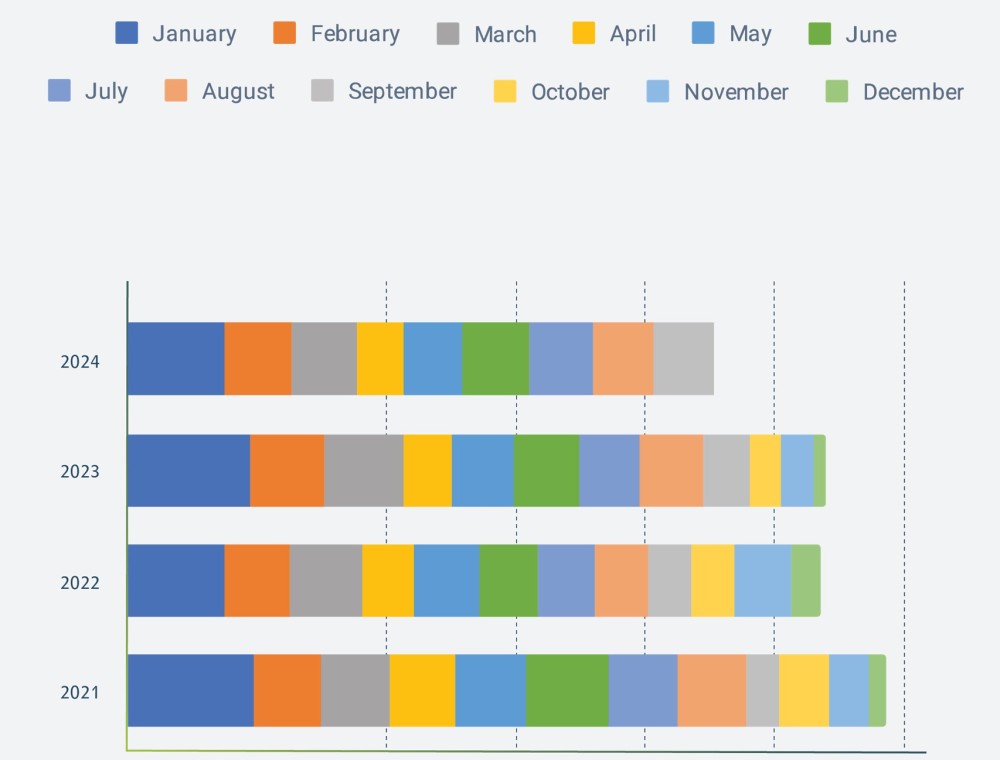

Registration Data

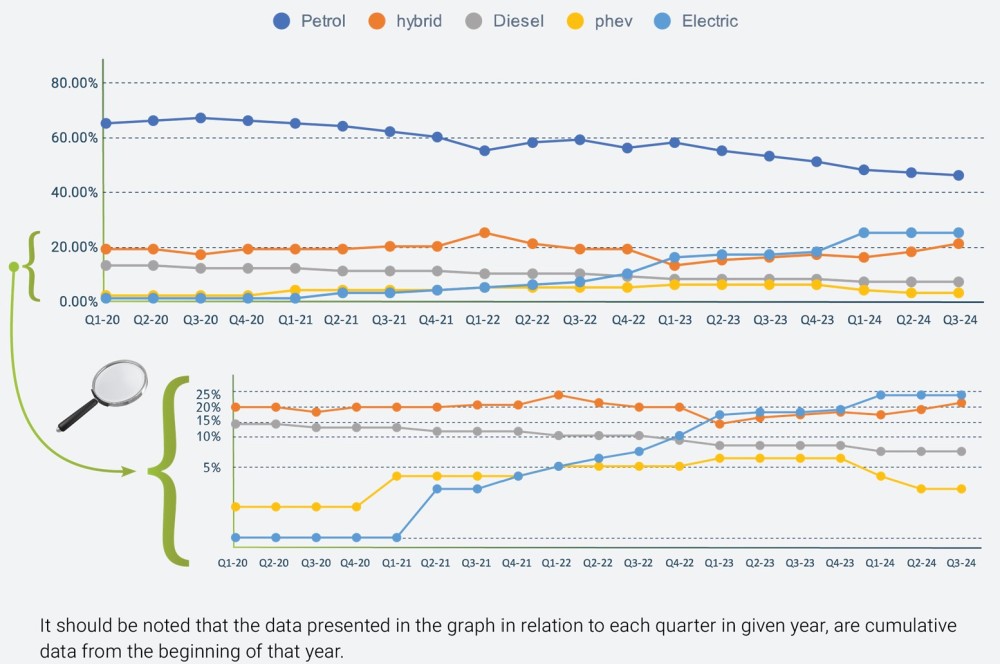

Registration by Engine Type

In Q3 2024, the market share for petrol vehicles dropped to 46% in Q3 2024, down from 47% in Q2 2024. This decrease continues the trend observed from 53% in Q3 2023 and 59% in Q3 2022, indicating a persistent shift away from petrol-powered vehicles as consumers increasingly opt for environmentally friendly alternatives.

Electric vehicles market share stood strong at 25% in Q3 2024, maintaining the same percentage as in Q2 2024. This stability comes after a substantial rise from 17% in Q3 2023 and a dramatic increase from just 7% in Q3 2022, highlighting a swift and robust consumer shift towards electric vehicles.

Hybrid vehicles In Q3 2024, hybrid vehicles increased their market share to 21%, up from 18% in Q2 2024 16% in Q3 2023 and 19% in Q3 2022, showing a resurgence in popularity.

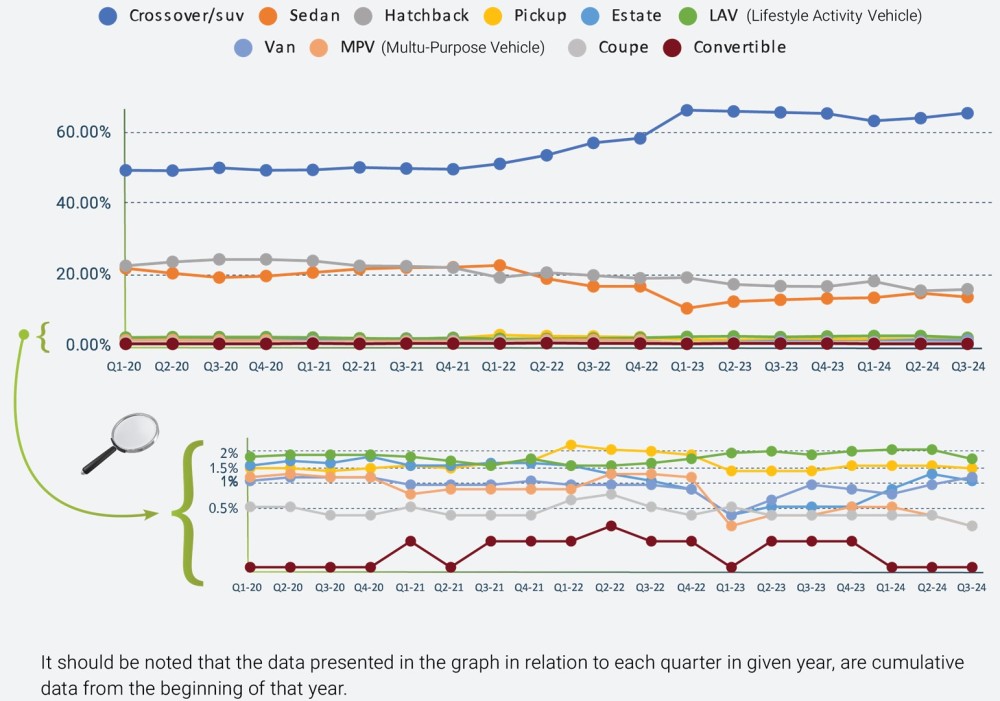

Registration by Segment Type

In Q3 2024, the Israeli automotive market displayed nuanced changes across vehicle segments:

Crossover/SUV Segment is demonstrating a robust performance over the years, maintaining a dominant market share. From an initial 49% in Q1 2020, it steadily climbed, reaching a peak of 65% multiple times through 2023 before slightly adjusting to 65.1% in Q3 2024. The enduring appeal of Crossover/SUVs underscores their popularity among Israeli consumers, reflecting a strong preference for spacious and versatile vehicles. Sedan Segment saw a marginal increase to 14.4%, up from 13.1% in Q1 2024. While this shows improvement, it is still down from the 18.5% share in Q2 2022 and notably lower than the 21.2% in Q2 2021, reflecting a gradual but persistent decline in sedan popularity amid the growing preference for SUVs. The Hatchback Segment has shown relative stability with slight fluctuations over the years. The market share hovered around 23% in early 2020, experienced some growth, and reached a peak of 23.9% by the end of 2020. However, the segment has seen a more pronounced decline recently, falling to 15.5% by Q3 2024. This represents a significant drop of 3.1 percentage points from 18.6% in Q3 2023 and a more substantial decrease of 5.5 percentage points from 21% in Q3 2022.

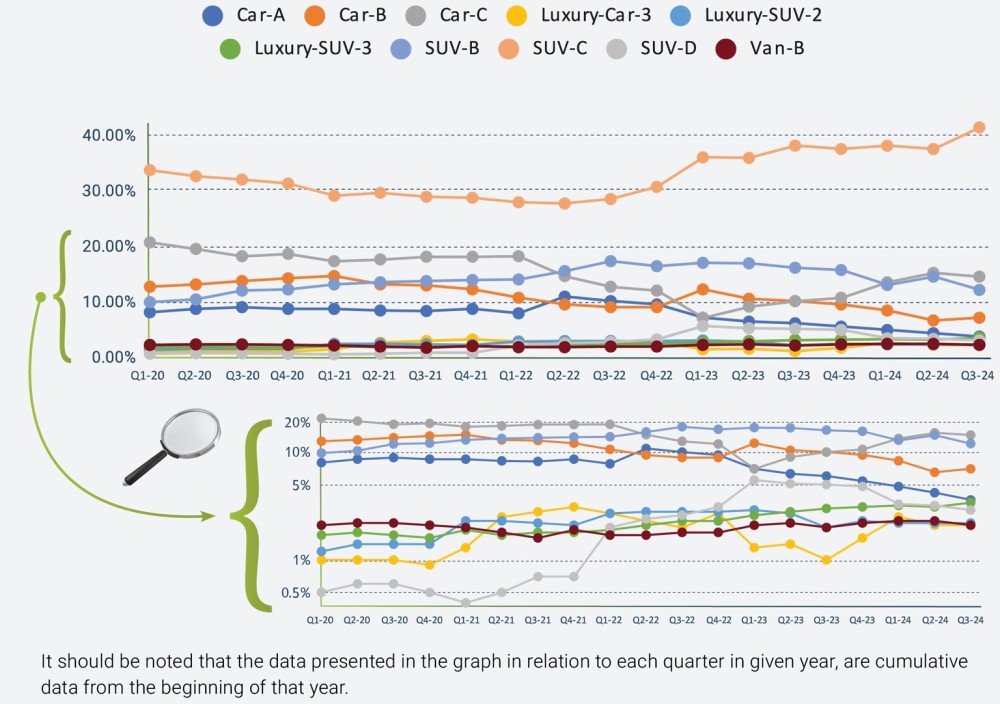

Registration by Category

SUV-C category has shown robust growth and market resilience. From a substantial 33.6% in Q1 2020, the SUV-C segment experienced an increase to a peak of 41.3% by Q3 2024, up from 37.4% in Q2 2024. Compared to 38% in Q3 2023 and a significant jump from 28.4% in Q3 2022, this growth underscores the sustained popularity and increasing consumer preference for larger, more versatile vehicles.

Car-C Category initially holding a market share of 20.6% in Q1 2020, Car-C vehicles saw a gradual decline over the years, dropping to a low of 10.0% in Q3 2023. However, there was a notable recovery to 14.4% by Q3 2024, which is a rise from 13.4% in Q2 2024.

SUV-B Category The SUV-B segment has demonstrated a notable trend of fluctuation over the years. Beginning at 9.8% in Q1 2020, the segment experienced a steady increase, peaking at 17.2% in Q3 2022. Since this peak, the market share saw a gradual decline but stabilized somewhat in later years. By Q3 2024, the share was recorded at 12.0%, slightly down from 14.4% in Q2 2024.

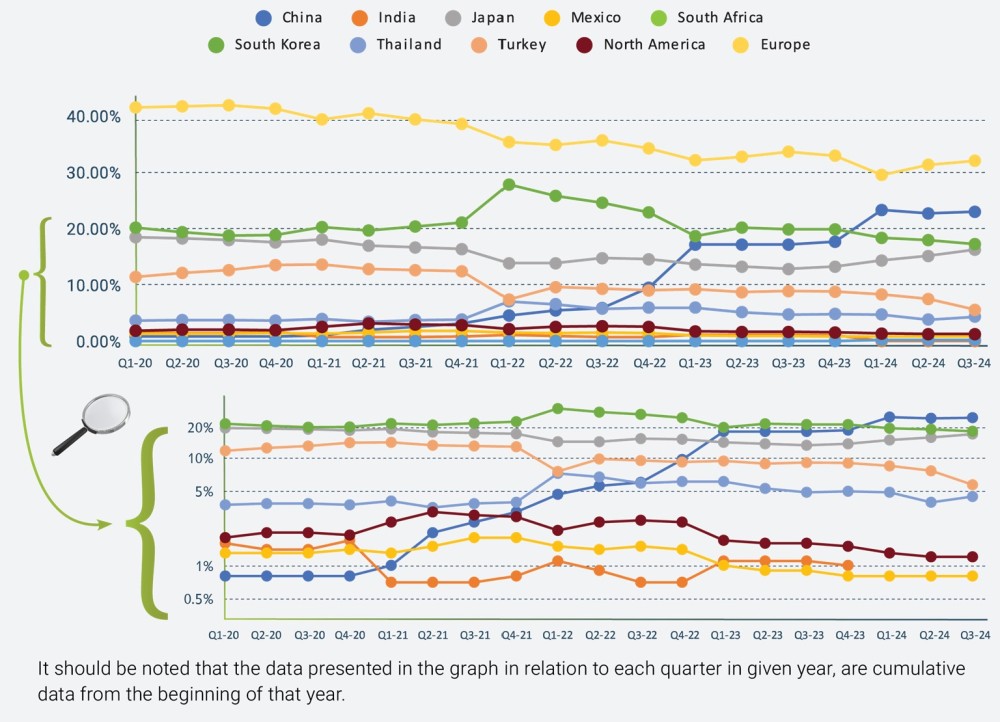

Registration by Country of Origin

European vehicles: have consistently held the largest share in the Israeli market, starting from 41.2% in Q1 2020, the market share reached a peak of 41.6% in Q3 2020. By Q3 2024, the share had declined to 31.8%. This decrease reflects a shift from 33.4% in Q3 2023 and a more noticeable drop from 35.4 % in Q3 2022.

Chinese vehicles: Starting from a low base of 0.8% in Q1 2020, Chinese-manufactured vehicles have experienced significant and consistent growth in the Israeli market. By Q3 2024, their market share slightly decreased to 22.8%, down from 22.5% in Q2 2024. Despite this minor quarter-to-quarter reduction, the overall trend remains highly positive, showing an increase from 17% in Q3 2023 and a dramatic rise from just 5.8% in Q3 2022.

South Korean vehicles: South Korean vehicles reached their market peak at 22.7% in Q1 2021 but have since experienced a gradual decline. By Q3 2024, the market share adjusted to 17.1%, down from 17.8% in Q2 2024, showing a decrease from 19.7% in Q3 2023 and a more pronounced drop from 24.4 % in Q3 2022.

Japanese vehicles have maintained a steady presence in the market. After starting at 18.3% in Q1 2020, their share has seen minor fluctuations, stabilizing around 14% in recent quarters, with a slight increase to 16.1% in Q3 2024 from 15% in Q2 2024.