Monthly Review July 2021

August 18, 2021

Preface - Economic Climate

The Israeli economy is an advanced economy that belongs to the OECD organization. The GDP per capita is $ 46,176 and the growth rate in 2010-2019 was the average annual growth rate of 3.3% per year. At the beginning of the Corona crisis, the debt-to-GDP ratio was 60% , one of the lowest in the Western world. The government deficit was 3.7% and the unemployment rate was 3.4%.

The Corona crisis has affected the Israeli economy as significantly as other economies in the world. The deficit in August 2020 – July 2021 is 9.3% from the GDP, the debt-to-GDP ratio is 75.8%. The unemployment rate rose to 5.2% but the unofficial unemployment rate climbed to about 9.0%. The new government sent a positive signal to the markets by passing a new budget for the first time in 3 years. From a monetary point of view, the crisis is being managed professionally by the Bank of Israel, which is monitoring the local credit market and solving liquidity problems through plans to purchase bonds and keep interest rates low.

In July the fourth wave of corona virus began to spread; however, the restrictions on the economy were minimal. The grant to businesses and unemployed workers was discontinued. As a result, the Israeli economy is functioning again and there was a decrease in unemployment. The fourth wave can cause a setback in the recent month's achievements. There's an unclarity as to whether Israel will be able to meet the target set by the chief economist of the Ministry of Finance, which is a growth of 4.6% in 2021.

Along with economic stabilization, there has been an increase in the inflation rate, as of July the annual rate is 1.7%. The chief economist in the ministry of finance predicts a similar increase next year as well; an increase in prices and inflation is a factor that must be taken into account in the coming years.

Statistical Profile: Israel July 2021

Society

Population (June 2021): 9.364 Million

Economy

GDP per capita: $46,176

Inflation: 1.7% Annual Growth Rate

Current Account Balance (Q1 2021): 5.51% of GDP

Trade in Goods and Services (July 2021) :$11.6 billion

Finance

US Dollar Exchange rate: NIS 3.27

Euro Exchange rate: NIS 3.86

Long-term interest rates (July 2021):0.84% Per Annum

Short-term interest rates (July 2021): 0.02% Per Annum

Government

Debt to GDP ratio: 75.8%

Deficit to GDP: 9.3%

Motorization

Level of Motorization (Q4 2019): 394 Vehicles/1,000 Residence

Innovation and Technology

Gross Domestic Spending on R&D (2019): 4.94% of GDP

Environment

CO2 Emissions (2019): 7 Tonnes Per Capita

Jobs

Employment Rate (Q1 2021): 65.40% of Working Age Population

Official Unemployment Rate (June 2021): 5.23% of Labour Force

Unofficial Unemployment Rate (including non-paid absence due to Corona) (June 2021): 9.0%

New Cars and CV Registrations

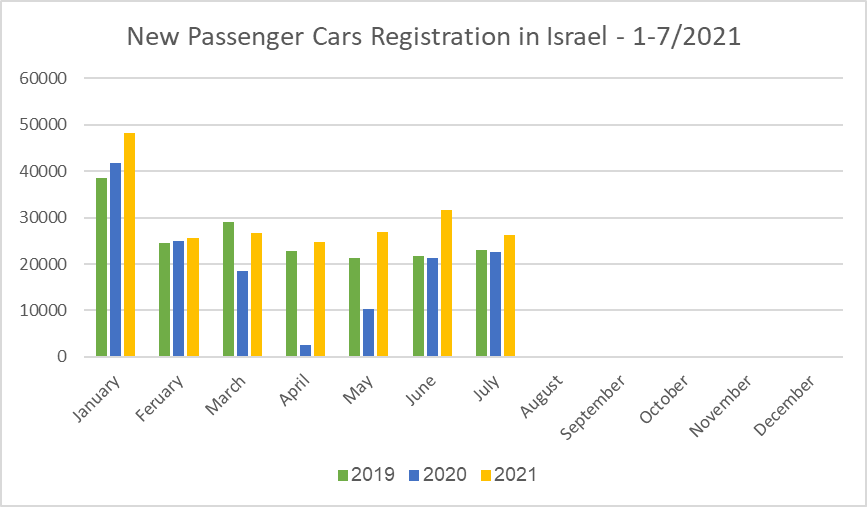

Israel New Passenger Car Registration – January-July 2021

Passenger car registration: +15.3% compared with July 2020; Since January 2021, an increase of 47.9% compared with Jan-July 2020.

In July 2021, the Israeli passenger car market registered 26,177 new cars. This figure represents an increase of 15.3% compared with June 2020. Since January, 209,978 new cars were registered – an increase of 47.9% compared with Jan-July 2020, and a new registration record for the first 7 months of the year.

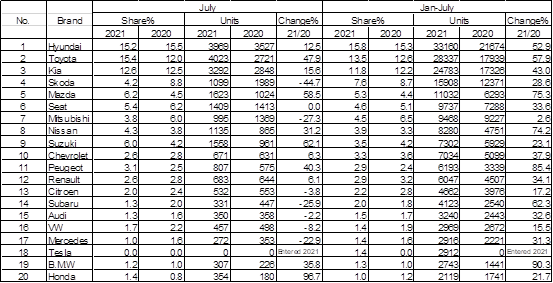

New Passenger Cars Registration in Israel 1-7/2021 According to Brands

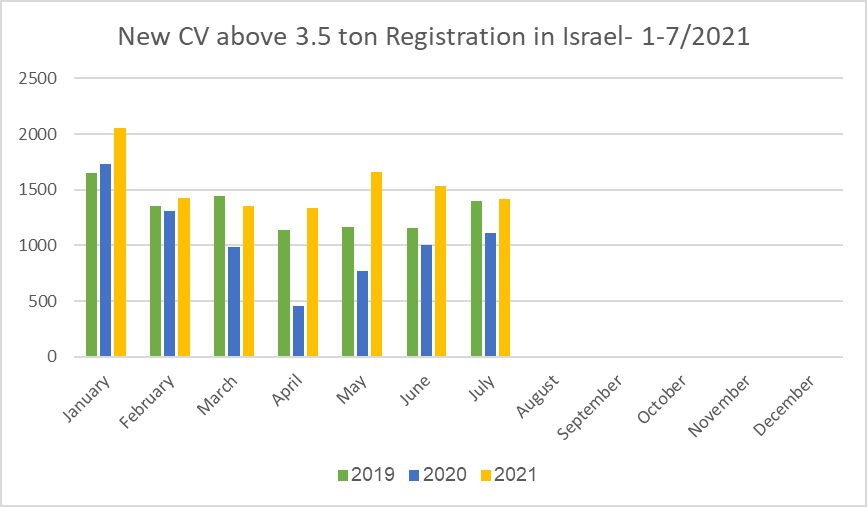

New CV above 3.5 ton and Bus Registration in Israel 1-7/2021

Commercial Vehicles above 3.5 ton registration: +27.8% compared with July 2020; Since January 2021, an increase of 46%

In July 2021, the Israeli market for CV above 3.5 ton registered an increase of 27.8% with 1,420 new listings, compared with 1,118 units in July 2020. Since January 2021, 10,778 new CV and buses were registered – an increase of 46% compared with Jan-July 2020.

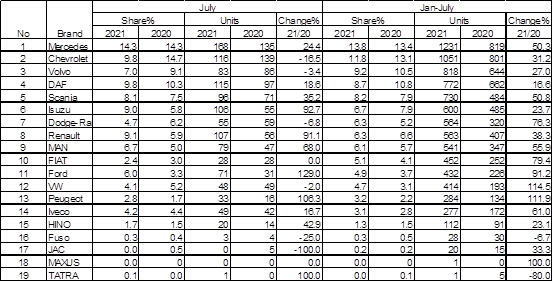

New CV above 3.5 ton Registration in Israel 1-7/2021 According to Brands

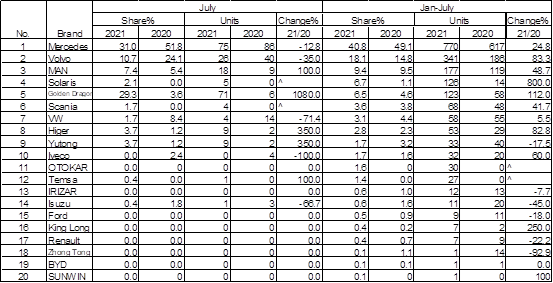

New Bus Registration in Israel 1-7/2021 According to Brands

Monthly review – Israel's Auto and Auto-Tech industry

Israeli Start-up Waycare Acquired by Rekor Systems

An Israeli Start-up Wayacare, a developer of a SaaS platform for gathering and analyzing data from multiple sources, was acquired by American Rekor Systems that develops AI solutions for intelligent infrastructure. Rekor will pay 61M$ in cash and common stock, and the entire Israeli team of around 50 employees will join the American company.

Jungo Connectivity Completes a 27M NIS First IPO

Jungo Connectivity, a leading AI company which develops software for in-car monitoring cameras, completed its first IPO. The company's leading product CoDriver enables monitoring of the car and driver awareness, distraction, number of occupants, child forgetfulness and additional parameters. The company raised 27M NIS, which represent a post-money valuation of 250M NIS.

Israeli Electric Corporation to Install SaverOne Systems

SaverOne, a developer of driver monitoring system, announced a new agreement with the Israeli Electric Corporation, according to which the company will install SaverOne systems in 300 electric corporation trucks. The deal followed a pilot stage that's been carried out during the past six months. This arrangement is an addition to all the agreements the company had reached with Flex Israel for the installment of 250 systems and Millennium Group for 250 systems and additional transactions.

RAD and Netivey Ayalon to Install Smart Traffic Cameras on 5G Infrastructure

Telecom company RAD and Ayalon Highways were chosen by the Israeli Ministry of Communications and the Innovation Authority to carry out a pilot project using 5G infrastructures. The RAD's SecFlow product will be used as an industrial IoT gateway, in order to connect traffic cameras and stream live video over 5G network, without requiring additional fiber-optics.

Tesla Expands its Operations in Israel

Just a few months after landing in Israel Tesla intends to expand its operations. The company verified that the quick-charging Supercharger network it deployed will be open in the future for non-Tesla owners as well. Additionally, the company is recruiting employees in order to start operating in the institutional market, and sell cars to leasing and rental companies as well as taxis.

Ministry of the Environment: By 2025, Only Electric Buses

The Israeli Ministry of the Environment published a draft to the Clean-Air Law, according to which by 2025 public transportation operator will have to purchase only electric buses. The draft states starting from 2023 at least 50% of the buses purchased must be electric, by 2024 the ratio will be 75% and by 2025 all new buses will have to be electric. The ministry estimates that if the draft will pass, by 2026 60% of the buses in Israel will be electric as will be 100% of the urban public transportation fleet by 2035. Currently, it is estimated that only 5% of the PT buses in Israel are electric.